Summary

Revenue was flat YoY at $1.08B, landing at the top end of guidance, with stable performance across consumables and instruments.

Non-GAAP profitability exceeded expectations, with operating margin at 24.5% and EPS at $1.34 — supported by cost controls, favorable NovaSeq X mix, and share buybacks.

NovaSeq X adoption remains the key growth driver, with the migration running ahead of schedule and representing over half of revenue this quarter.

Management has raised its full-year guidance after this solid quarter result.

Illumina has released its 3Q25 earnings. Doing an update on their latest performance. If you want to know in-depth about their business, click here.

📊Financial Highlights

Overall, Illumina delivered a clean beat quarter. Revenue hit the top end of guidance. Both operating margin and EPS are above expectations.

Despite revenue being mostly flat, the company is becoming more profitable, thanks to ongoing cost controls and a more favorable mix from the NovaSeq X platform.

The company repurchases 1.24 million shares for $120 mil in 3Q25, contributing to non-GAAP diluted EPS growing 17.5% yoy despite their quarterly revenue being flat.

In my previous post, I highlighted 3 main challenges Illumina faces:

#1: US Funding Cuts💵

Illumina’s target customers can be broken down into 2 segments:

Research & Applied

Clinical

The Clinical segment is more resilient, as it is directly integrated into healthcare applications such as oncology testing, genetic disease testing & reproductive health diagnostic. In contrast, the Research & Applied segment is cyclical because its customers are research institutes. Their spending on Illumina’s products depends on government funding.

As of 3Q25, the clinical segment continues to be the one doing the heavy lifting. Revenue in this segment is growing at double-digit (excluding China), +12% growth. This is driven by broader adoption of comprehensive genomic profiling and growing use of sequencing-intensive applications like MRD.

The sequencing consumables revenue for research & applied segment continues to decline in high-single digit (excluding China), -8% declined, due to funding uncertainty. One positive note from the management is the demand seems to be stabilizing. Nonetheless, they still expect this funding uncertainty to continue in 2026.

#2: Tariffs👮

While the US sweeping tariffs do not have significant impact on Illumina’s performance, the Management mentioned for 3Q25 it had a 2.2% impact on gross margin.

#3: China’s Regulatory Restrictions🚫

Revenue contribution from China continues to decline and is now only 5% of Illumina’s total revenue for 3Q25. However, management mentioned that:

“Illumina has received approval to manufacture certain instruments locally for OEM partners in China.”

This is not a full solution, but it’s a small step forward while instrument exports to China remain restricted. Overall, I still view China as a “bonus upside” at this point rather than a core driver. Thus, my valuation will continue to exclude this market until there’s some level of certainty.

Growth #1: NovaSeq X Transitioning Well📋

This continues to be Illumina’s biggest growth engine. As of 3Q25:

More than 55 NovaSeq X instruments were placed in the quarter. This is in-line with their goal of 50 to 60 placements per quarter.

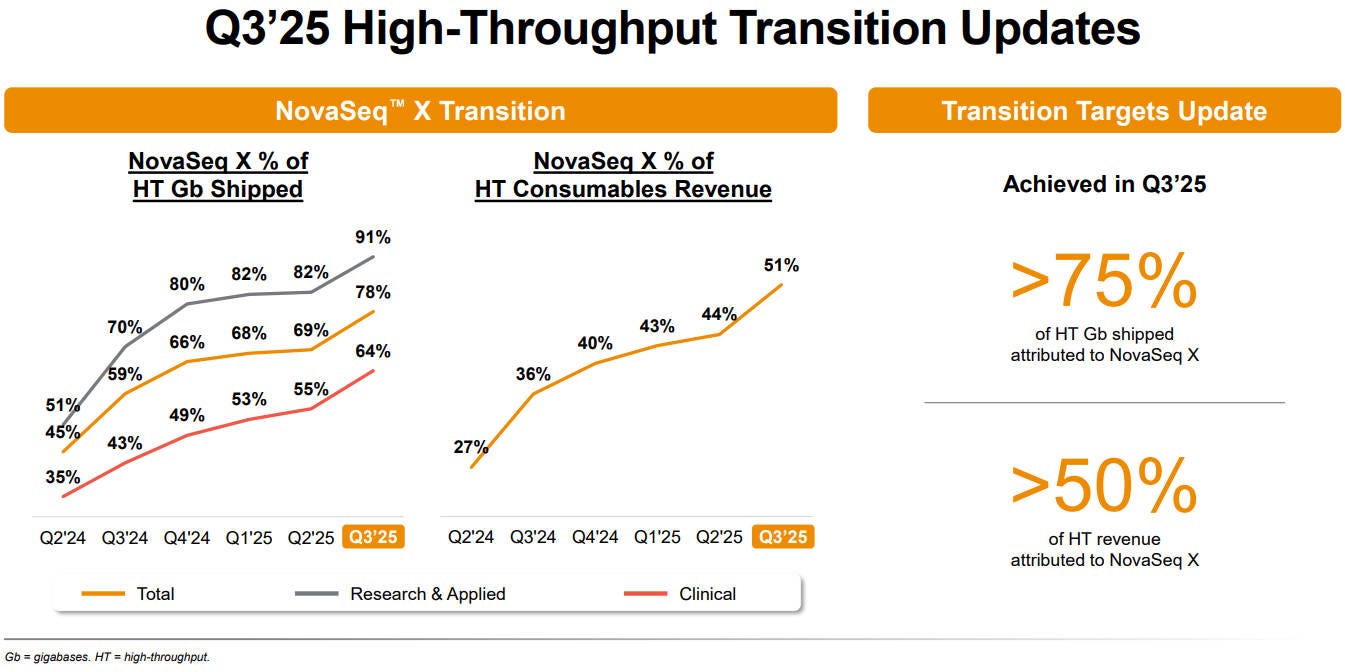

Roughly 78% of volumes and 51% of revenue in Q3 was sequenced on NovaSeq X.

91% of research volumes & 64% of clinical volumes have already transitioned to NovaSeq X. This means there is still room for growth in instrument sales within the clinical segment.

🎯Future Guidance Raised

Overall, this quarter’s result is very solid with expansion of operating margin. The management has again raised their full year’s guidance:

⚖️Valuation

As mentioned in my previous post, this remains a waiting game. But judging from this 3Q25 result, the only major problem that hinders the company’s growth is its research segment. With the demand normalizing, I believe Illumina will do better from 2026 onwards.

I am not adjusting my valuation of Illumina. This is because my previous assumptions are already conservative (at the worst case scenario). The intrinsic value remains in the range of $156.98 to $180.75.

Disclaimer:

The information provided in this blog post is for informational purposes only and should NOT be construed as financial advice. Investing in stocks and ETFs involves risk, and there is no guarantee of profits. Past performance is not indicative of future results. It is important to conduct thorough research or consult with a qualified financial advisor before making any investment decisions. The author is NOT a financial advisor and is sharing his personal experiences and opinions only.

Additionally, please note that the author holds a position in the discussed stock, and his view may be biased as a result.