Summary

Financial Performance: ILMN's FY2024 revenue was $4,372 million, down 2.9% from FY2023. Free cashflow will soon reach its historical high of $891 mil

NovaSeq X Transition: Sales have slowed, with 278 orders shipped in 2024 compared to 352 orders in 2023

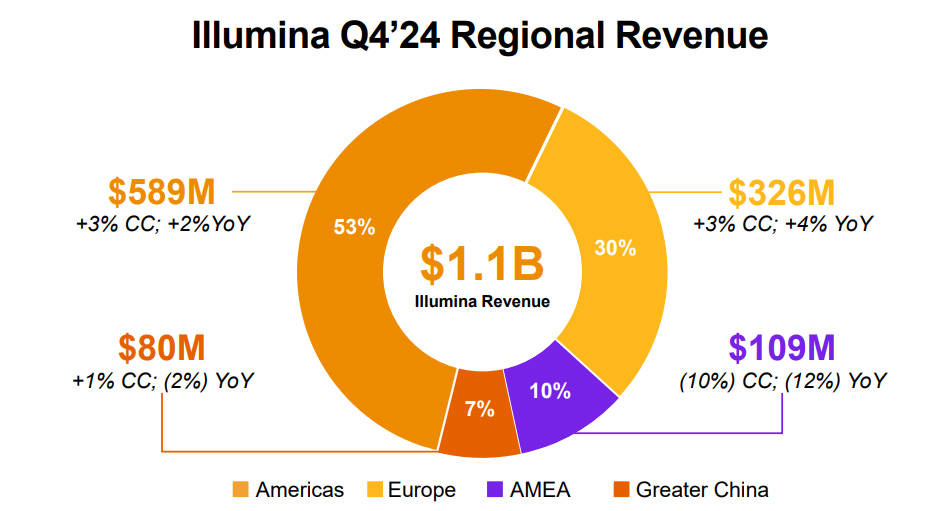

China Market Challenges: Revenue from China decreased, contributing only 7% of total revenue in FY2024. Trade tensions have impacted ILMN's share price

Valuation: Despite disappointing revenue growth, the company’s valuation remains attractive but might take longer to unlock value

In my last post, I discussed the potential turnaround ILMN might experience. Since then, they have released their Q4 2024 results. Here’s an update on their performance so far.

Financial Highlights

The lower reported revenue in FY2024 was mainly due to lower instrument sales. Nevertheless, this is offset by an increase in consumables of approx. 2% y-o-y.

On the bright side, free cashflows have jumped when compared against FY2023. If this continues, it will soon reach its historical high free cashflows of $891 mil (in FY2020).

Higher free cashflows allow the company to pare down its debt or perform stock buybacks. During the year, it has repurchased 134,000 shares at average price of $129.02. This is good, as it will increase the EPS. Hope to see more in 2025 onwards.

NovaSeq X Transition Progress

There seems to be a slowdown in sale of NovaSeq X series instruments which led to the decline in instrument sales. In 2024, there were 278 orders shipped. This is lower than in 2023 when 352 orders shipped. The total installed base now stands at 630 units.

As of 4Q24, approx. 40% of high-throughput consumables revenue was on NovaSeq X series. Unfortunately, ILMN does not disclose the breakdown of consumables revenue by instrument type. Regardless, at just 40% of high-throughput consumables, it means that there are still room for growth in instrument sales.

Market Headwinds - China woes

China market continues to decline in revenue. For FY2024, it only contributed 7% of total revenue. This is a 2% reduction from FY2023.

The recent announcement of 10% tariff on China’s products by Trump has made the Chinese government to retaliate. Unexpectedly, ILMN was placed under the “unreliable entity list” which could risk it being sanction.

Because of this, ILMN’s share price tanked further. I guess the market is pricing ILMN as if there’ll be no more revenue from China going forward (at least during the trade war period).

ILMN’s CEO said that they are currently in a dialogue with relevant parties from Chinese Ministry of Commerce to reach a solution.

Regardless, China only accounts for 7% of total revenue and it has been struggling to recover even before this issue. So, this will be a bonus for ILMN if ever it could recover. Even if it doesn’t, the max exposure is still just 7%. Not a big deal in my opinion.

2025 Full Year Guidance

Some catalyst to boost its revenue are:

New consumables (e.g. flow cells) for advancing multiomic applications

MiSeq i100 was launched in 4Q24 and so far, has already placed 70 units

Lowered Valuation

It’s a rather disappointing result, especially on the revenue growth. The only positive is its free cashflow soon reaching historical high level of $891 mil in FY2020. It looks like ILMN is going to take a detour before fully turned around.

Taking the worst case scenario as follows, the intrinsic value is now lowered to between $153.47 to $180.75:

Illumina completely out from China market (7% reduction in revenue) while revenue from other regions remain flat. The revenue per share would be approx. $25 per share for FY2025

Cashflow from operation continues to increase albeit at slower pace since China market is assumed to be doomed. I’m guessing at $6 per share for FY2025

Using -1 STD of 15 Yr median Price-to-Sales & Price-to-CF Ratio of 6.1x and 30.1x, respectively

With this extremely conservative valuation, ILMN is still undervalued with margin of safety between 34% and 44% at current price of $101.78 (at the time of writing). Nevertheless, this is a waiting game now for those who are vested. I will continue to update the company’s 1Q25 result.

Disclaimer:

The information provided in this blog post is for informational purposes only and should NOT be construed as financial advice. Investing in stocks and ETFs involves risk, and there is no guarantee of profits. Past performance is not indicative of future results. It is important to conduct thorough research or consult with a qualified financial advisor before making any investment decisions. The author is NOT a financial advisor and is sharing his personal experiences and opinions only.

Additionally, please note that the author holds a position in the discussed stock, and his view may be biased as a result.