Summary

Revenue declined by 2.7% YoY, with flat performance in consumables and instruments

However, non-GAAP diluted EPS grew by 9% YoY despite revenue declined

The company faces on-going challenges from US funding cuts and tariffs but supported by resilience in clinical market segment.

Management has raised its full-year guidance after a good quarter result.

Illumina has released its 2Q25 earnings. Doing an update on their latest performance. If you want to know in-depth about their business, click here.

📊Financial Highlights

Not surprising, most of its revenue segments are either down or flat. On the bright side, its non-GAAP operating margin and diluted EPS are above expectations. The management’s action in controlling their expenses as mentioned in their previous quarter’s earnings release is working.

Non-GAAP operating expenses are down 6% yoy. The company repurchases 4.5 million shares for $380 mil in 2Q25. This has resulted in non-GAAP diluted EPS growing 9% yoy despite their quarterly revenue down by 2.7% yoy. The remaining amount Illumina is authorized to repurchase is approx. $800 mil.

In my previous post, I highlighted 3 main challenges Illumina faces:

#1: US Funding Cuts💵

Illumina’s target customers can be broken down into 2 segments:

Research & Applied

Clinical

The Clinical segment is more resilient, as it is directly integrated into healthcare applications such as oncology testing, genetic disease testing & reproductive health diagnostic. As of 2Q25, this segment accounts for roughly 60% of sequencing consumables.

In contrast, the Research & Applied segment is cyclical because its customers are research institutes. Their spending on Illumina’s products depends on government funding.

As Trump administration cuts the National Institutes of Health (NIH)’s budget, Illumina’s research customers continue to face funding constraints. Thus, lower sequencing instruments & consumables demand.

#2: Tariffs👮

Apparently, the US sweeping tariffs do not have significant impact on Illumina’s performance. The Management mentioned for 2Q25 it only had a 1.1% impact on gross margin. I think this provides some comfort for investors.

#3: China’s Regulatory Restrictions🚫

China now only contributes 6% of Illumina’s total revenue for 2Q25. It has become the smallest segment. I think it is not worth keeping track anymore. The only positive point is Illumina can still sell sequencing consumables to its China customers. The export of instruments into China is still restricted. I will still treat this market as gone completely.

Growth #1: NovaSeq X Transitioning Well📋

Both the funding cuts and tariffs are beyond Illumina’s control. Their main growth drivers are coming from clinical segment. As mentioned, 60% of sequencing consumables are from this clinical segment. Management is anticipating more to come relative to the research segment.

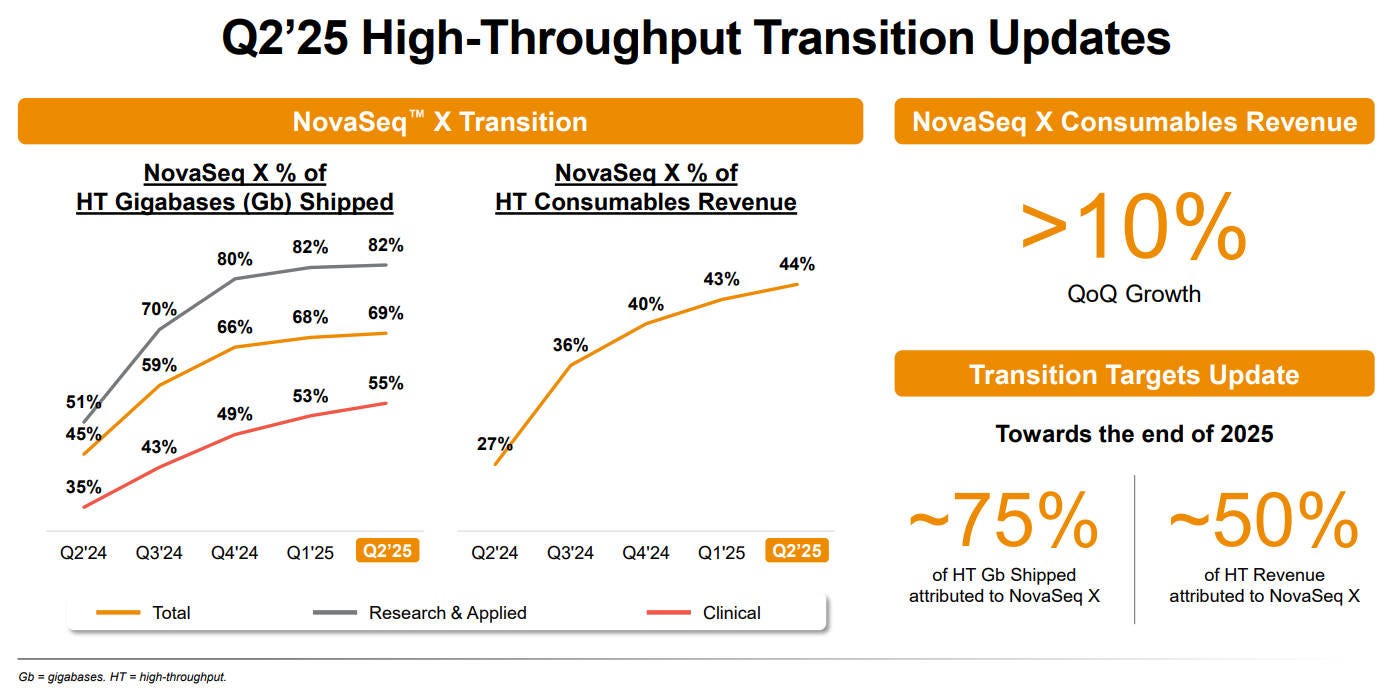

One factor I see is the company’s NovaSeq X transition progress. As of 2Q25:

Roughly 55% of sequencing volume for clinical segment already transitioned to this NovaSeq X series

For research segment, over 80% of sequencing volume has already transitioned

This means more instrument sales will be coming from their clinical segment moving forward. In 2Q25, approx. 44% of high throughput consumables revenue was on NovaSeq X series and the management anticipate achieving 50% by end of 2025.

Growth #2: MiSeq i100 Plus Sales📋

This is Illumina’s latest low throughput device. In 2Q25, the company has placed about 500 instruments. Management are seeing customers order additional units after just few months of use. Feedback remains positive.

Growth #3: Acquisition of SomaLogic📋

This company is a key player in high throughput proteomics. According to NIH, Proteomics is the study of the interactions, function, composition, and structures of proteins and their cellular activities. Proteomics provides a better understanding of the structure and function of the organism than genomics.

Somalogic’s Somascan able to analyze over 9,500 unique human proteins from small biological samples & deliver insights for drug discovery, diagnostics and health monitoring. How this contributes to Illumina’s growth remains to be seen.

🎯Future Guidance Raised

Overall, this quarter’s result is consider good. The management has raised their full year’s guidance:

⚖️Valuation

As mentioned in my previous post, this remains a waiting game. I still believe that the challenges Illumina is currently facing are temporary. How long until resolution? My best estimate would be until Trump is replaced with a new president – in 2028? Hahaha…

Despite the above uncertainties, I am not adjusting my valuation of Illumina. This is because my previous assumptions are already conservative (at the worst case scenario). The intrinsic value remains in the range of $156.98 to $180.75.

Disclaimer:

The information provided in this blog post is for informational purposes only and should NOT be construed as financial advice. Investing in stocks and ETFs involves risk, and there is no guarantee of profits. Past performance is not indicative of future results. It is important to conduct thorough research or consult with a qualified financial advisor before making any investment decisions. The author is NOT a financial advisor and is sharing his personal experiences and opinions only.

Additionally, please note that the author holds a position in the discussed stock, and his view may be biased as a result.