Summary

Unfocused portfolio: Current investments span various sectors making it difficult to track due to limited time

Streamlining Research Strategy: Focus on sectors that align with long-term secular trends as they have the highest growth potential such as AI and Cybersecurity

Diversification plan: Diversification is still important to avoid over-concentration risks. ETFs is a good tool to provide instant de-risk

Lately, I've been reflecting on how to maximize my limited free time for researching potential stock investments. I manage two portfolios: one focused on dividend growth and another on capital growth.

For my dividend growth portfolio, I concentrate on the markets in Malaysia, Singapore, and recently, Hong Kong. The main reason is that dividends in these markets are generally tax-free, except for Malaysian REITs, which have a 10% withholding tax.

My capital growth portfolio, on the other hand, is focused on the US market. This is because many US-listed companies have great businesses and long growth runways.

Maintaining these two portfolios is no easy task. I need to constantly monitor each position whenever earnings results are released. At the time of writing this journal, I have positions in the following sectors:

Breweries

REITs (retail, industrial, logistics & data centers)

Banks

Industrial materials

Semiconductor

Healthcare

Cybersecurity

E-commerce

Artificial intelligence

Communication services

IT hardware & peripherals

Understanding the latest developments in all these sectors can be quite challenging and time consuming.

Howard Marks once said:

“Second-level thinkers know that, to achieve superior results, they have to have an edge in either information or analysis or both.”

This quote resonates with me. How can I achieve superior results if I’m constantly trying to understand the various sectors' latest developments instead of just focusing on what matters most?

It’s literally “Jack of all trades, master of none”. My analysis won't have an edge if I keep shifting focus between various sectors instead of concentrating on a few key ones.

That’s why I came to a realization that I need to streamline my research and focus on sectors that have the highest potential growth. This way, I can make better-informed decisions and maximize my returns.

Investing in Big Trends to Maximize Returns

Simply Wall Street in its weekly article identified several secular trends:

Healthcare technology advancements

Aging population and growing middle class consumers

Acceleration in clean energy transition

Artificial intelligence, data and cloud infrastructure

Cybersecurity growing importance, etc.

These secular trends provide me with a guide to where my investment should be for the next 10 to 20 years. The idea is that companies within these secular trends are more likely to grow in terms of their earnings.

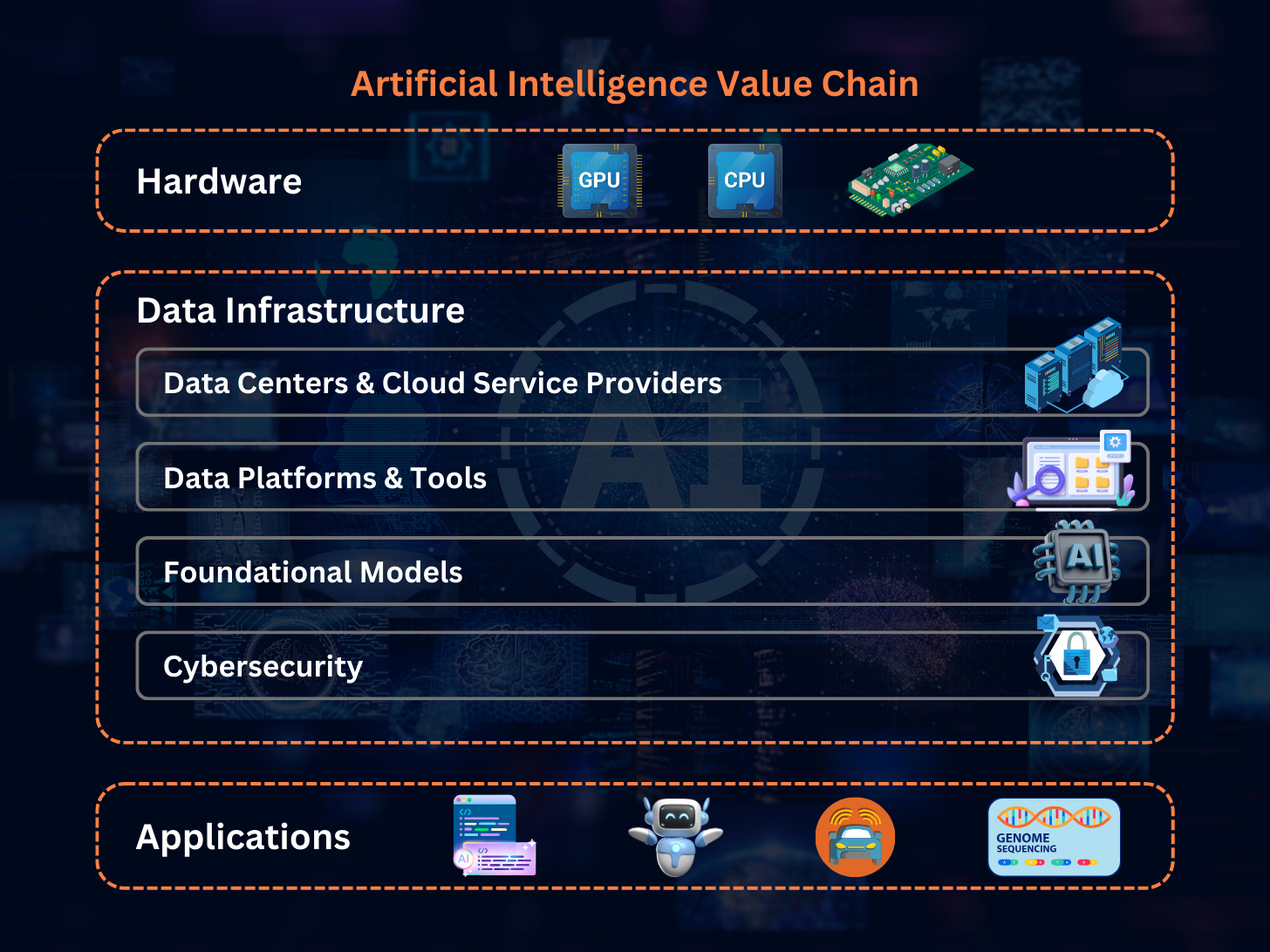

Now, I don't need to focus on every sector as above but rather on those with the highest potential for profits. For instance, artificial intelligence (AI) and cybersecurity are sectors I believe have the most impact on all other sectors and a long runway for growth because they act as enablers. They provide the tools, systems, and protections needed for other sectors to evolve and thrive.

Additionally, I’m choosing these sectors because of my IT background, being a CISA-certified professional. This makes it easier for me to understand the terminology and nuances when researching companies within these sectors.

My next problem is, how do I separate these into dividend and capital growth? Since I maintain 2 portfolios. I realized that I don't need to worry about whether an investment is for dividends or growth. Instead, I should view my portfolio as a whole and adjust according to the sectors I have chosen to focus on.

For example, within the AI value chain, there are various segments such as semiconductors, data centers, and networks. My research should identify companies within this value chain and classify them as either dividend or growth investments at later stage.

No doubt, most companies within this AI value chain are likely to be US-based. However, I believe other countries like Malaysia and Singapore also have companies within this value chain.

For instance, in Singapore, there are Keppel DC REIT and Mapletree Industrial Trusts, which invest in data centers. While in Malaysia, there are companies such as Time Dotcom and Tenaga National which provide connectivity and electricity to data centers, respectively.

What About Diversifications? Use of ETFs…

Yes, it is important to diversify my investments. I will definitely face huge fluctuations in my returns if I only focus on 1 particular sector.

Thankfully, there are various types of ETFs that can help me to diversify easily. So, I’ll be allocating some portion of my capital into ETFs as a way to diversify into other sectors that I won’t be focusing my research on.

This approach will help me make better use of my limited time and ensure my portfolio is well-aligned with long-term growth trends. I'm excited to start implementing this strategy and see how it transforms my investment journey this year (2025).

Perhaps, I will do an update to record how my portfolio has transformed later in the future.

Disclaimer:

The information provided in this blog post is for informational purposes only and should NOT be construed as financial advice. Investing in stocks and ETFs involves risk, and there is no guarantee of profits. Past performance is not indicative of future results. It is important to conduct thorough research or consult with a qualified financial advisor before making any investment decisions. The author is NOT a financial advisor and is sharing his personal experiences and opinions only.

Additionally, please note that the author holds position in the discussed stocks, and his view may be biased as a result.