Summary

KLSE to enter 2026 on stable footing, supported by OPR cut, stronger MYR, and improving domestic demand.

Consumer spending and corporate earnings should stay resilient, helped by civil service pay hikes and strong investment pipelines.

Data centre–related sectors remain the key growth engine, benefiting utilities, telcos, renewables, and construction.

This is my second part of my annual market outlook which focuses on Malaysia Market in 2026. If you have not read the first part on my outlook for global markets, click here to read it.

Malaysia in 2025 has been on recovery mode since Apr-25. Here’s my outlook:

MY Market: Remain Stable

Malaysia stock market had a -2.1% loss in 2025. Not surprising because most of the listed companies in Bursa Malaysia are old economy (e.g. mining, agriculture, property development, manufacturing, etc.).

Sectors that are booming in Malaysia is really data center and its related value chain (e.g. renewable energy, utilities, telecommunications, constructions, etc.).

There are several key events in 2025 that sets the stage for 2026:

Based on the above key events, I anticipate the overall Malaysia stock market to be slightly on bullish side. This is because of below views that are more bullish than bearish impact:

💸 Consumer Spending & Corporate Earnings to Increase

Both the OPR cut and pay hike for civil servants will definitely boost consumer spending in 2026.

Corporate earnings will also be resilient in 2026 as it is supported by:

Pipelines of investments (e.g. RM285.2 billion as of 3Q25) from both foreign countries and domestic investors which created over 150,000 jobs. This is a 13.2% increase from previous year.

Approximately 62.8% of export goods to US are exempted from the reciprocal tariff rate of 19% set in Oct-25. This will increase the US demand for Malaysia’s goods as prices becomes competitive against countries with reciprocal tariff.

The stronger MYR against USD will lower input costs for companies that source their supplies in USD

💱 MYR strengths to continue

That said, earnings growth may be more visible among domestically focused companies, while net exporters could come under pressure from higher forex losses and tighter margins in 2026.

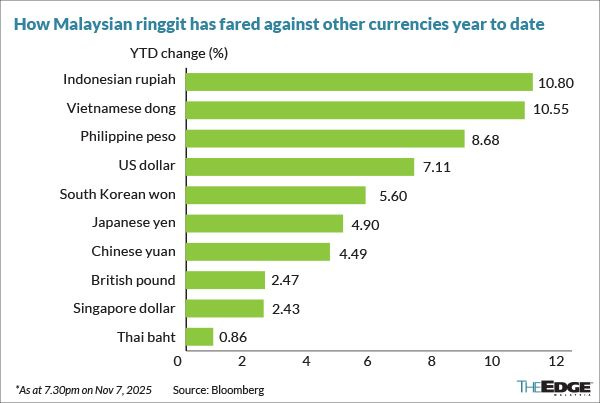

According to MARC Ratings, they are foreseeing that USD will continue to strengthen till mid-2026. The MYR’s performance in 2025 was not limited to the USD alone, it also strengthened against several other major currencies.

Below snapshot shows how MYR fares against other currencies as of Nov-25:

Malaysia’s top 10 export destinations for 2024-2025 are Singapore, US, China, Hong Kong, Japan, Taiwan, Thailand, Indonesia, South Korea, and Vietnam. Interestingly, the MYR strengthened against the currencies of most of these trading partners.

Looking deeper, semiconductor products remain among Malaysia’s largest export categories. As a result, I expect the E&E sector’s financial performance to be affected the most in 2026.

💾 Data Center Related Sectors to Continue Booming

I anticipate that sectors within the Data Center (DC) value chain will continue to experience earnings growth due to:

Budget 2026 tabled in Oct-25 places heavy emphasis on digital infrastructure, AI, cloud, and data ecosystem development which indirectly supports DC growth in Malaysia.

As an indicator of DC growth, Tenaga has secured a total of 49 DC projects as of 3Q 2025. This is already higher than 2024 by 28.9%.

Below are sectors that I believe will continue to do well in 2026:

📈 Inflation could increase

I believe there’s always a possibility that inflation could rise in Malaysia. In Jul-25, Tenaga adjusted its tariff structure which will result in higher electricity costs for commercial & industrial businesses. As they are the typical high energy usage, especially data centers.

I’m pretty sure business owners will pass on these extra costs to their customers.

My Plan for 2026

Just like I said in my previous outlook post, my goal is to position my portfolio to capitalize on long-term secular trends. This yearly market outlook doesn’t prompt me to alter my portfolio positions; rather, it only serves as assurance whether my long-term view has change or not.

Unless there is a big structural trend change such as “AI is just a hype”, I will continue to focus my portfolio in this sector heavily while maintain some position in other sectors for diversification purposes.

For my paid subscribers, here is what I’m planning to do in 2026 for each market: