Summary

US Market: Expect to end the year positively but there will be high volatility during the year due to new Fed chair and mid-term elections.

HK Market: To continue its uptrend despite the market is on the expensive side as the government vows more accommodative policy.

SG REIT Market: To continue its uptrend recovery as the lagging effect from lower interest rate starts to show in their 2026 financial performance

Now that 2025 is done and dusted, it is time to do a yearly market outlook on markets that I’m currently invested in – US, SG, MY and HK. This annual outlook isn’t about precision forecasting but building a framework to organise my thoughts around the key events from 2025 that could impact my portfolio in 2026 and beyond.

Like the famous quote from Benjamin Franklin, “If you fail to plan, you’re planning to fail”. This annual outlook will help me plan my actions forward. I’m splitting this annual outlook into 2 parts. First part focuses on global markets. The second part will be solely on Malaysia market as combining it will make this blogpost too long.

Here’s my outlook for 2026:

US Market: Volatility Ahead

2025 has been a bullish year despite the market getting hit with Trump’s sweeping tariffs in Apr-25. The S&P 500 has gained 18.1% supported by their thriving economy. GDP was initially shrank by -0.6% in 1Q 25 before turning around and gaining steam, growing at +4.3% as of 3Q 25.

Inflation was under-controlled. The core CPI (excl. food & energy prices) rises to only 2.6% as of Nov-25, which is less than anticipated 3% increase. The US Fed carried out below actions in 2025:

Cut interest rates 3 times, bringing down the interest rate to 3.5% – 3.75%.

Ending the quantitative tightening (QT) from 1st Dec 2025 onwards

The Dot plot now shows 2 more cuts – 1 in 2026 and 1 in 2027. However, I anticipate that the market in 2026 will be volatile. This is because:

📉 Technical Pullback is Due

Based solely on technical chart, SPX is hovering just slightly above its previous high of 6,917 points (potential resistance). Since the market don’t move in straight line, I think there will be a pullback – how much? I was hoping for -5.4%, given how expensive the market is right now.

At the time of writing, the SPX Index is trading at PE of 31.28x, which is above the 10-yr median PE of 23.81x. The market is definitely not cheap right now.

🏦 New US Fed Chair in May 2026

The current US Fed Chair, Jerome Powell is expected to leave in May 2026. Trump is expected to put someone that agrees with his views of having rate cut to 1%. The general market does not like uncertainties and so, I anticipate there will be volatility during this time until we know who the new US Fed Chair is – “Sell in May and go away?”

🗳️ US Mid-term Elections in Nov 2026

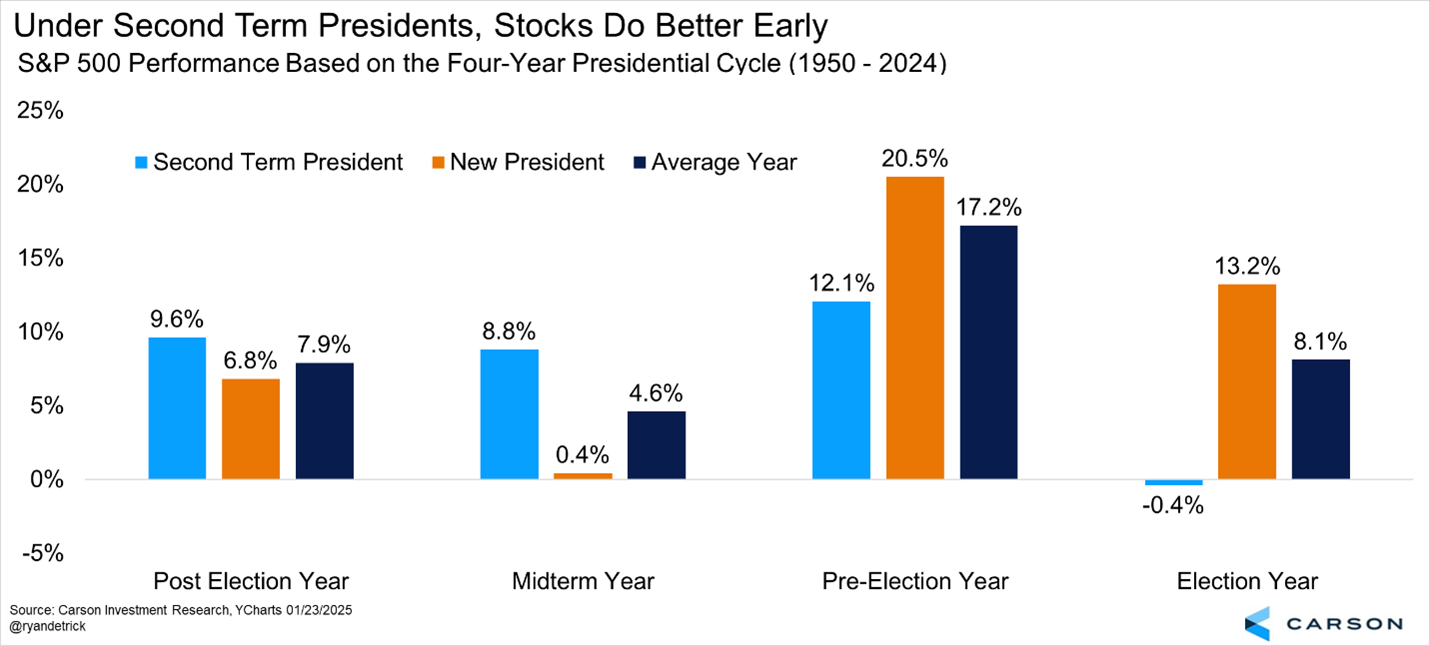

According to Carson Investment Research, the years with mid-term elections are generally weakest in terms of the market returns but it also depends on whether it is the first term or second term president. For Trump’s case, it is the latter. Hence, not too bad.

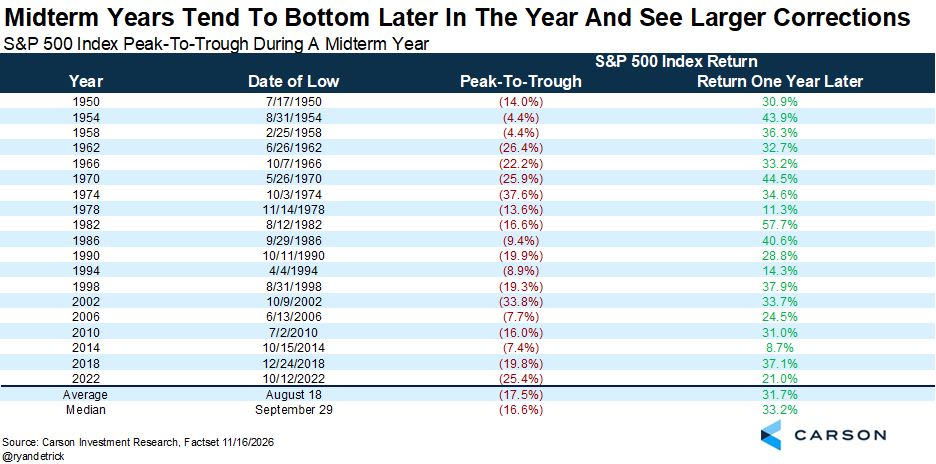

That said, anything can happen. I somehow have the feeling that 2026 will be like 2022 where there’s a big correction for the whole year before recovering in 2023. The chart below from Carson Investment Research shows that the correction for mid-term years tends to last until later part of the year.

Nevertheless, I think the US market will still end the year 2026 positively because:

#1: Lower US Fed Fund Rate & Higher Liquidity in Market

The US federal funds rate is expected to see one more cut in 2026, and the QT program has already ended. This is positive for markets, as liquidity conditions are becoming more supportive of growth because the money supply increases.

This typically benefits risky assets by lowering financing costs, improving access to capital, and encouraging investment flows into equities and longer-duration assets.

#2: Extra Booster from Trump’s One Big, Beautiful Bill

This bill introduced by Trump could boost the US economy through tax cuts on:

Individuals which could result in $100 billion in tax refunds. This will increase the US consumer spending.

Corporation which could result in $137.2 billion reduction in tax liability.

HK/ China Market: Uptrend Continues 🚀

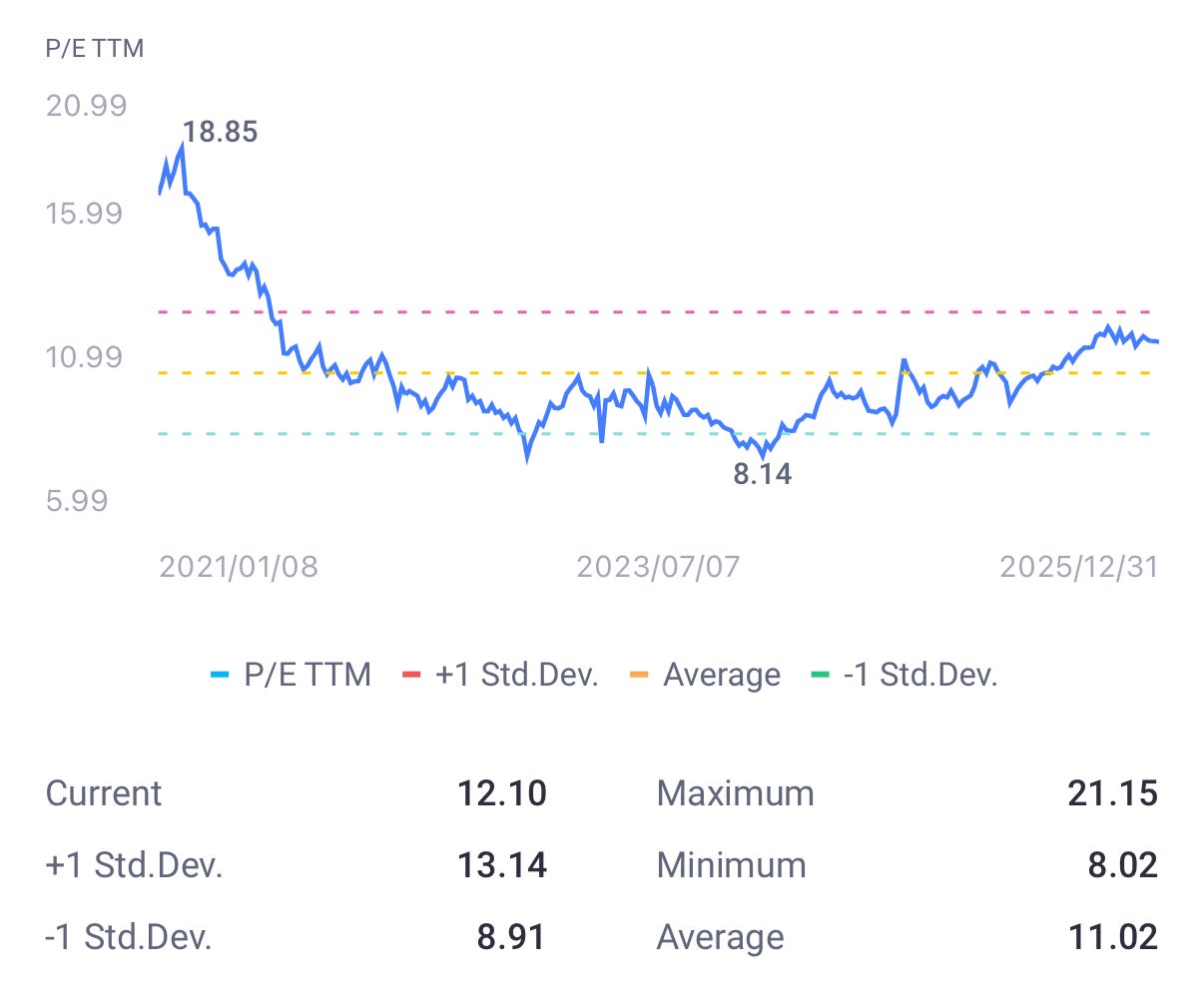

The Hong Kong market had a strong run in 2025, climbing roughly 27%. On a 5-year PE basis, valuations are starting to look a little expensive, sitting above the average of 11.02x. Still, market don’t reprice overnight. With HK and China still recovering from years of crackdowns and property-related crisis, higher valuations can persist longer than expected.

At the same time, earnings recovery and continued government policy support could help justify higher valuations, as investor confidence gradually rebuilds.

There are few bullish points that I believe HK market will continue its uptrend in 2026:

China’s PBOC cut its key lending reference rates for its one-year and five-year’s Loan Prime Rates (LPR) once by 0.10% in May 2025. This will ease the burden of borrowers.

In Dec-25, adjustments were made to lower the risk factors for insurers’ stock investments. This will encourage greater stock market participation from insurers.

Additionally, China’s major tech companies such as Tencent, Alibaba, and ByteDance could benefit from renewed momentum in AI development if Trump administration allows Nvidia to sell H200 chips to these Chinese firms. We may see more innovations in the AI space.

It’s still uncertain whether this would invite new competitors to copy Nvidia’s GPU designs, mainly because China does not yet have access to ASML’s EUV machines needed to manufacture advanced chips. Until that hurdle is cleared, China remains behind in the semiconductor race.

If China eventually cracks this challenge, greater GPU supply could normalize today’s tight demand environment. This is similar to how China’s EV manufacturers have increased competitive pressure on US and European automakers. I digress.

SG REIT Market: Benefit from Lower Interest Rate

This section is intentionally narrow to just REIT market in Singapore (SG). I’m not making a call on the entire Singapore market because my exposure is limited to SG REITs, and that’s where my analysis sits.

SG REITs tend to move with interest rates, since borrowing costs play a big role in their growth and distributions. 2025 turned out to be a recovery year, helped by rate cuts across the US, Europe, Hong Kong, and China. Over time, this should ease financing costs for REITs with exposure to these markets.

Still, this low interest rate relief doesn’t come instantly. For REITs with fixed-rate debt, lower interest costs only show up when loans mature and are refinanced.

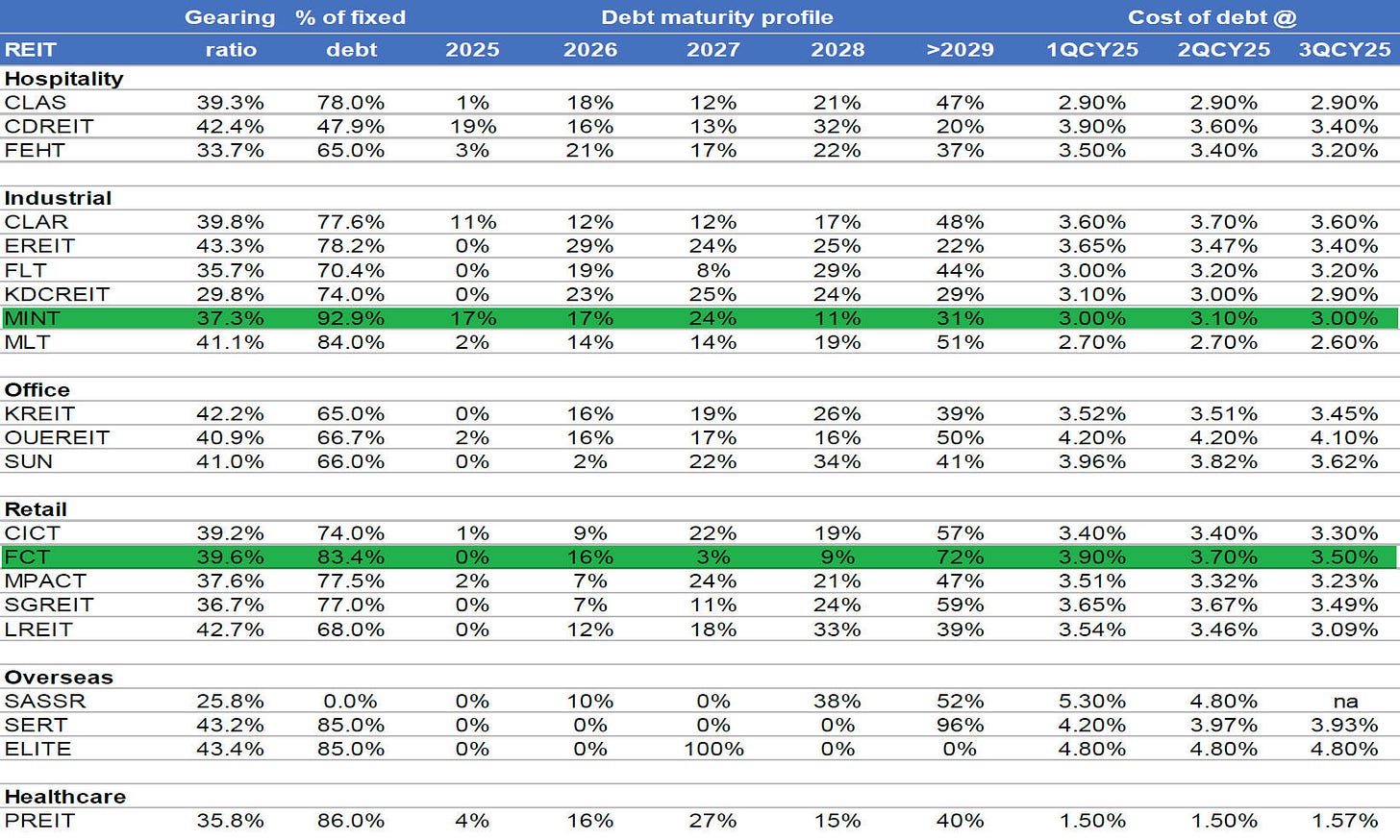

Below are some SG REITs’ debt profile I took from CIMB research:

I highlighted my current position in SG REIT – Mapletree Industrial Tr (MINT) and Frasers Centrepoint Tr (FCT). MINT is going to refinance 34% of their total debt between 2025 & 2026. While FCT is refinancing 16% of their total debt in 2026.

I’m not worried about FCT because the retail sector in SG still resilient. In October 2025, retail sales, excluding motor vehicles, grew 3.7% picking up from September which is 1.8%.

The one I’m watching closely is MINT’s performance because of reasons I have listed in my previous post on “Portfolio Review” – you can read it here. The only positive thing I see is the continued rate cuts in 2026. It could offset some of their loss of income from asset divestments.

In summary, I think SG REIT will continue its recovery supported by these rate cuts globally. All eyes on their Budget 2026 – this is one uncertainty ahead.

Closing Thoughts

For 2026, I anticipate all 3 markets – US, SG and HK/ China – to be bullish for reasons as above. That said, there will be some volatility coming from US due to the unpredictability of Trump’s administration.

Stay tuned for my outlook on Malaysia market and my plan for 2026.

Disclaimer:

The information provided in this blog post is for informational purposes only and should NOT be construed as financial advice. Investing in stocks and ETFs involves risk, and there is no guarantee of profits. Past performance is not indicative of future results. It is important to conduct thorough research or consult with a qualified financial advisor before making any investment decisions. The author is NOT a financial advisor and is sharing his personal experiences and opinions only.