Summary

Hardware powers AI by supplying the computational strength required for ML and DL.

The semiconductor value chain comprises fabless, foundries, and OSAT companies.

Supportive segments — IP suppliers, design tool vendors, and equipment providers — enable chip production.

AI hardware revenue is set to grow at a 24.3% CAGR, driven by major tech investments and policy shifts.

This is the first instalment of my in-depth exploration of the AI value chain, beginning with hardware.

Hardware forms the backbone of AI development, providing necessary computational power to train and deploy AI models. These hardware are mainly chips designed to handle the massive data and complex computations required by ML and DL algorithms.

In a typical computer, there are 3 major components (FYI, these are also collectively known as semiconductor chips):

💻Computation (CPU and GPU)

💽Memory (RAM)

💾Storage (Drives)

The computation component (in particular, GPU) handles the training of AI models. While the storage drives are used to store massive data required for ML and DL. The memory ensures efficient processing by reducing the time to access data from slower storage drives.

Additionally, specialized AI accelerator chips are often used as well to handle more intensive computational demands.

Below are some of the specialized chip design for AI development purpose:

Companies that design and manufacture these chips are those from semiconductor industry. Like any industry, it has its own value chain. Below is an overview:

The semiconductor value chain has 3 core segments:

✍Fabless

The term "fabless" refers to companies that design and market semiconductor chips but do not own the fabrication facilities (fabs) to manufacture them. Instead, they outsource the manufacturing process to specialized foundries.

This business model allows fabless companies to focus on innovation, research, and design without the significant capital investment required for building and maintaining fabs.

Some of the notable fabless companies include NVIDIA, Qualcomm, and AMD. In recent times, AAPL also is considered to be a fabless company due to their introduction of Apple Silicon in all their hardware.

🏭Foundry

Foundries are specialized companies that manufacture semiconductor chips for other companies, including fabless firms. They provide the infrastructure and expertise needed to fabricate chips according to the specifications provided by their clients.

Below are the leading foundries:

This is one of the bottleneck that contributes to the shortages of semiconductor chips worldwide during the pandemic. Currently, only TSMC and Samsung are capable of producing advanced chips which are 5nm and smaller nodes.

TSMC produces an estimated 90% of the world's super advanced semiconductor chips which are used to power AI applications.

🔬Outsourced Semiconductor Assembly & Test (OSAT)

OSAT companies provide third-party services for the assembly, packaging, and testing of semiconductor devices. They bridge the gap between semiconductor foundries and end consumers by ensuring that chips are properly packaged and tested before being shipped to customers.

Major OSAT companies include ASE Technology Holding, Amkor Technology, and Powertech Technology. The OSAT market is driven by the increasing demand for advanced packaging solutions and the growing complexity of semiconductor devices.

However, there is little to no product differentiation. Hence, companies in this segment often compete by being the lowest costs producer. They do not have pricing power.

There are 3 additional segments that complement and support the 3 core components mentioned above. They are known as:

📱IP Suppliers and IC Design Tools

The manufacturing process of a chip begins with the creation and verification of a digital integrated circuit (IC) blueprint. A photomask is created with the IC design pattern on it.

An ultraviolet light is then used to print the IC design from the photomask to the silicon wafer. Thereafter, the silicon wafer will go through process like etching and deposition to form an operational chip.

Below is an example of Apple M3 silicon IC design patterns:

Tools like Electronic Design Automation (EDA) are essential for such blueprint design because it allows engineers to simulate the circuitry until the layout is perfected. Companies that provide such tools include Cadence Design Systems, Synopsys, and Mentor Graphics.

If companies do not prefer to create IC blueprint from scratch, they can choose to purchase the license from Intellectual property (IP) suppliers. These suppliers provide pre-designed and pre-verified building blocks, known as IP cores, that semiconductor companies integrate into their own chip designs.

IP cores are like “Lego pieces” where it has pre-made blocks like CPU core, a memory controller or a communication interface. Companies just need to focus on the parts that make their chip unique while relying on proven blocks for common functions.

Some of the leading IP suppliers include ARM, Synopsys, Imagination Technologies, CEVA Inc and Cadence Design Systems.

🛠️Materials and Specialized Equipment Suppliers

This segment supplies the raw materials and specialized equipment needed for semiconductor manufacturing, including silicon wafers, photomasks, and deposition equipment.

Companies like Applied Materials, ASML, and Lam Research are some of the key players in this segment. Especially ASML. This company is a specialized equipment supplier which manufactures and sells ultraviolet lithography machine that are used to print the IC design onto the silicon wafer.

Currently, ASML holds a monopoly in supplying extreme ultraviolet (EUV) lithography systems, which are essential for manufacturing advanced semiconductor devices. These machines are the only one capable of printing extremely fine integrated circuit patterns on silicon wafers, enabling the production of chips at 7nm process nodes and below.

There are no other suppliers that manufacture such machine.

🔎Testing Equipment Suppliers

Companies in this segment provide tools and systems used to test semiconductor chips, either during or after production. This includes automated test equipment (ATE), handlers, and probers.

Testing equipment ensures that semiconductor chips meet quality and performance standards before they are integrated into electronic products. Companies such as Advantest, Teradyne, and Cohu are prominent suppliers in this segment.

Unfortunately, it’s a tough business. Companies in this segment depend heavily on foundries’ orders and there aren’t many big foundries in the world. When there are many companies competing for a share of the foundries’ orders, price wars are inevitable. Of course, this only happens when the demand for chip starts to peak.

📊AI Hardware to Grow at 24.3% CAGR

The AI hardware are projected to grow at a CAGR of 24.3% from 2024 to 2033 in terms of revenue. The US tech giants like Alphabet, Microsoft, Meta, and Amazon are still increasing their AI and data center investments to $320 billion in 2025, up from $230 billion in 2024.

This is despite of the Deepseek-R1 model – China’s version of ChatGPT-o1 model – launched in January 2025 which raises questions about the necessity of exorbitant AI development budgets. The AI model claims to have only spend approximately $6 million in training cost while OpenAI’s ChatGPT costs an estimated $100+ million.

However, there’s another concern that could impact the growth of these chip makers’ revenue which is the U.S. AI Diffusion Policy. It was announced in January 2025 and is expected for US companies to comply starting 15 May 2025.

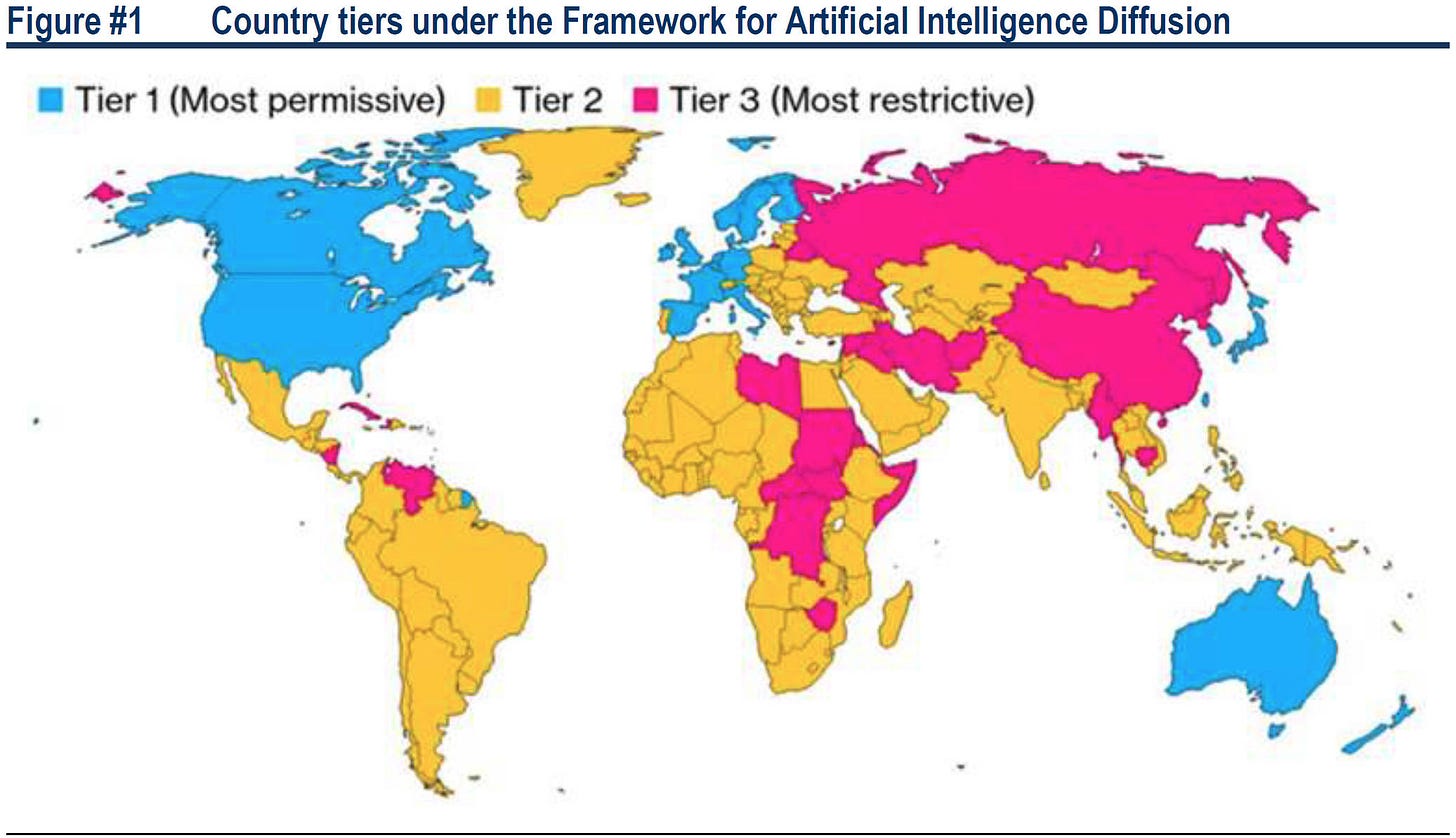

The policy essentially restricts the export of advanced chips used to develop AI. It divides countries into 3 tiers:

On the bright side, Trump’s administration has announced on 7th May 2025 that they plan to replace this AI Diffusion Policy with a new policy.

It remains to be seen what does the new policy entails and its potential impact. Only time will tell…

Disclaimer

The information provided in this blog post is for informational purposes only and should NOT be construed as financial advice. Investing in stocks and ETFs involves risk, and there is no guarantee of profits. Past performance is not indicative of future results. It is important to conduct thorough research or consult with a qualified financial advisor before making any investment decisions. The author is NOT a financial advisor and is sharing his personal experiences and opinions only.

Additionally, please note that the author holds a position in the discussed stock, and his view may be biased as a result.