Summary

Three main categories of AI use cases: Generative, Predictive, and Physical AI, each with distinct use cases and revenue models

Generative and Predictive AI, relying on subscription-based models, face customer retention challenges amid intense competition

Business risks of physical AI are highly industry-specific

This is the fourth and final instalment of my in-depth overview of the AI value chain, focusing on Applications. It explores how Machine Learning (ML) and Deep Learning (DL) are integrated into real-world use cases, driving value across industries and enhancing our daily lives.

At its core, AI applications empower businesses to streamline operations and improve decision-making, resulting in substantial value additions to their bottom lines. These applications can be standalone AI software or embedded as add-on features within existing software systems.

AI applications can be broadly categorized into three key areas:

⚛️Generative AI

Generative AI is what most people are actively using today – examples include ChatGPT, Gemini, and DeepSeek. These applications enable the creation of new content and typically operate on a subscription-based revenue model.

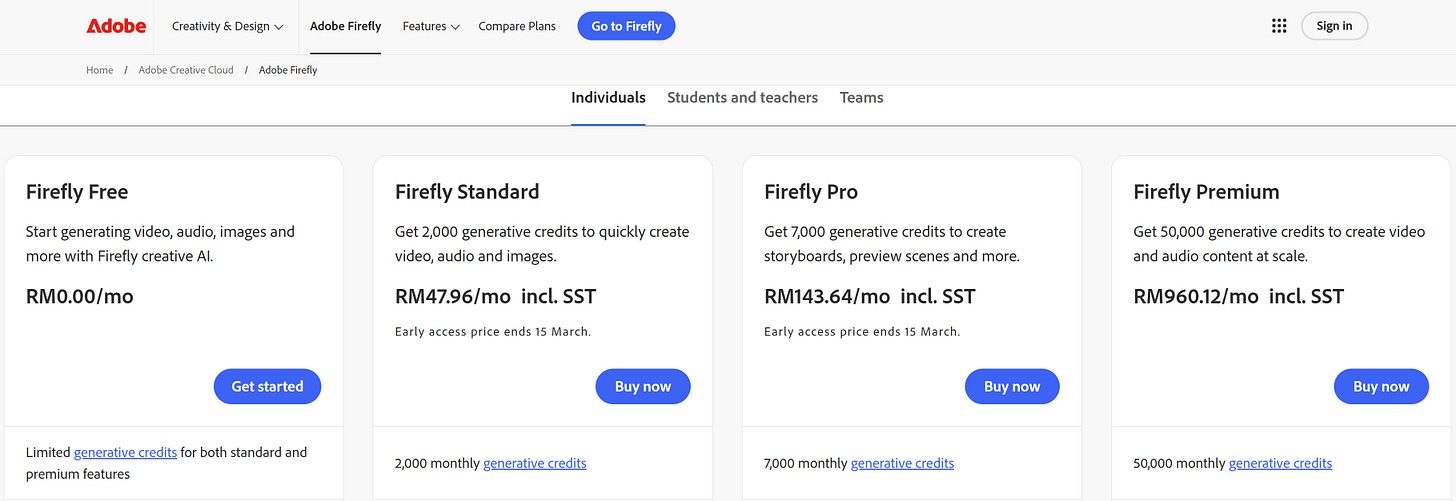

For instance, Adobe has introduced its own generative AI solution, Firefly, which allows users to produce images, audio, and video content.

Statista projects that the generative AI market will reach nearly $66.9 billion by 2025, growing at CAGR of 37% from 2025 to 2031. This growth is fueled by increasing enterprise adoption, particularly in the realm of digital assistants and AI agent.

📊Predictive AI

This refers to AI technologies that are embedded into existing software applications. It’s like an additional feature. It is able to recognize patterns in large dataset and predict the outcome. Yes, it is the ML and DL algorithm – foundation elements of all AI technologies.

For example:

🎬Netflix uses the ML algorithm to recommend shows that their users would like to watch. They don’t charge this AI feature. Instead, it’s already part of their content subscription fees.

🛡️CrowdStrike integrates ML into its cybersecurity platform, Falcon, to analyze massive datasets, detect patterns, and adapt to emerging threats. Predictive AI in this context enhances the functionality of existing systems rather than being a standalone application.

🤖Physical AI

Physical AI involves the integration of artificial intelligence with robotic and automation systems that interact directly with the physical world. Applications span multiple industries:

🚗Automotive: Autonomous driving technologies, like Tesla’s Autopilot and Waymo’s driverless taxis, leverage DL algorithms embedded in safety and navigation systems

🏥Healthcare: Companies such as Intuitive Surgical develop robotic surgical systems that use AI for precision and safety in minimally invasive procedures

🏭General Manufacturing: AI-driven machine vision systems, like those from Cognex Corporation, play critical roles in automated quality control, inspection, and optimization of production processes.

⚠️Key Business Risks

Both the generative AI and predictive AI are mostly operating a “software-as-a-service” (SaaS) model. From an investor’s perspective, the primary risk associated with this model is customer retention, given the intense competition among similar applications.

What makes a customer want to continue the subscription & perhaps buy more add-on features? There’s an article from Sequoia Capital – a venture capital company, it highlights two key factors that create stickiness and loyalty which is:

Workflows – how AI tools integrate into users’ work processes

User networks – the community and ecosystem built around the AI tools

As an investor, these two will be the key metrics to monitor & determine whether these AI companies have competitive advantage.

As for Physical AI, in my opinion, its business risks are very industry specific. For example, within the manufacturing industry, automation is important to enhance productivity & efficiency. However, competition can be very intense as there are many companies that provide such automation solutions to these manufacturers.

Additionally, the income stream is often non-recurring in nature since these automation solutions require bidding (project based) while the maintenance can be performed by others or at a discounted pricing.

🔎Conclusion

As a long-term investor, I prefer companies with high income predictability because:

It will not give me surprises such as sudden drop in revenue

Forecasting the company’s earnings growth would be much easier & reliable

Based on this, I think most of the investment opportunities will be in the generative and predictive AI categories.

This concludes my comprehensive analysis of the AI value chain and marks the beginning of my new investment strategy. Moving forward, I will be posting my in-depth research into AI-related stocks. If you’re interested in following my journey, be sure to subscribe for more insights!

Disclaimer:

The information provided in this blog post is for informational purposes only and should NOT be construed as financial advice. Investing in stocks and ETFs involves risk, and there is no guarantee of profits. Past performance is not indicative of future results. It is important to conduct thorough research or consult with a qualified financial advisor before making any investment decisions. The author is NOT a financial advisor and is sharing his personal experiences and opinions only.

Additionally, please note that the author holds a position in the discussed stocks, and his view may be biased as a result.